SAP FI (Financial Accounting) Course Contents

Introduction to ERP and SAP FI

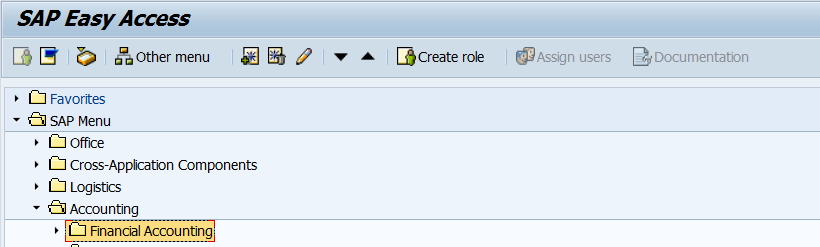

Navigating SAP ERP

Basics

• Map the accounting structure of a company in SAP.

• Create a company code.

• Describe the use and advantages of the variant principle

• Explain the necessity and use of a fiscal year variant

• Explain different types of fiscal year variants

• Define a fiscal year variant

• Assign the fiscal year variant to a company code

• Define currencies.

• Describe the meaning of different exchange rate types

• Maintain exchange rates

• Use the different tools for maintaining exchange rates

• Explain the options for maintaining exchange rates

• Set up document types and number ranges.

• Utilize and explain posting keys.

• Configure and test validations and substitutions.

General Ledger

• Define and use a chart of accounts

• Explain the advantages and disadvantages of group and country chart of accounts

• Describe the structure of a general ledger account

• Control the format of a general ledger account

• Name and describe different types of general ledger accounts

• Create, maintain and control general ledger accounts

• Describe how you can change several general ledger accounts at the same time

• Maintain exchange rates.

• Create and reverse general ledger transfer postings.

• Post cross-company code transactions.

• Create profit centers and segments.

• Clear an account.

• Maintain tolerances.

• Maintain tax codes.

• Perform postings with document splitting.

• Parallel accounting with the accounts and ledger approach.

• Describe the structure of accounting documents

• Open and close periods

• Open and close posting periods differently for different account types

• Define the amounts that specific groups of accounting clerks are allowed to post

• Assign users to a tolerance group for highest amounts

• Post simple documents in FI

• Define default values

• Configure user/specific default values

• Determine default values in the system and the configuration

• Explain the rules governing changes to documents

• Change documents

• Analyse changes to documents

• Reverse documents

• Find reversal reasons in customizing

• Define terms of payment

• Explain the account determination for automatic postings of cash discounts

• Describe the treatment of taxes

• Create tax codes and define tax accounts in the configuration

• Explain cross-company code transactions

• Post cross-company code transactions

• Explain the clearing process

• Clear and account

• Post with clearing

• Post incoming and outgoing payments

• Reset clearing

• Post payment differences

• Describe tolerance groups and their role for posting payment differences

• Post partial and residual payments

• Create and use payment difference reason codes

• Explain the system treatment of exchange rate differences

• Describe special GL transactions

• Explain the particularities of special GL transactions

• Explain the functions of special GL transactions

• Configure special GL transactions or check their configurations

• Create your own special GL transactions as needed

• Describe the functionality of document parking

• Identify the difference between parking documents and holding documents

• Park FI documents

• Edit, delete, or post parked documents

• Describe how to use the workflow when parking documents

• Name the advantages of using workflow when parking documents

Banking Ledger

• Maintain bank master data.

• Define house banks.

• Create a cash journal and assign it to a GL account

• Explain business transaction categories

• Create business transactions

• Save and post business transactions in the cash journal

Accounts Payable

• Define and use a chart of accounts

• Describe the structure of a general ledger account

• Control the format of a general ledger account

• Name and describe different types of general ledger accounts

• Create, maintain and control general ledger accounts

• Describe how you can change several general ledger accounts at the same time

• Create and maintain vendor accounts.

• Post and reverse invoices and payments and use special GL transactions.

• Manage partial payments.

• Block open vendor invoices for payment.

• Configure and use the payment program.

• Define the customizing settings for the Payment Medium workbench (PMW).

• Create a payment medium using the PMW.

• Use the debit balance check for handling payments.

• Set up dunning and execute dunning.

• Define terms of payment and payment types.

• Understand integration with procurement.

Accounts Receivable

• Create and maintain customer accounts.

• Post invoices and reverse and payments and use special GL transactions.

• Manage partial payments.

• Define terms of payment and payment types.

• Explain the connection of customers to vendors.

• Set up correspondence and send periodic account statements.

• Understand integration with sales and distribution.

• Create special GL indicators and post with special GL indications.

Asset Accounting

• Create and maintain chart of depreciations and the depreciation areas.

• Create and maintain asset classes and asset master data.

• Configure and perform FI-AA business processes in the SAP System.

• Setup valuation and depreciation.

• Perform periodic and year-end closing processes.

• Explain and configure parallel accounting (with the accounts solution)

• Assign a chart of accounts and a chart of depreciation to a company code

• Describe how asset accounting is integrated with cost accounting

• Assign asset classes to assets

• Define which depreciation areas post their values to the general ledger

• Process mass changes using a worklist

• Post integrated and non-integrated asset acquisitions in the system

• Post integrated and non-integrated asset retirements in the system

• Represent intracompany and intercompany asset transfers in the system

• Represent assets under construction in the system

• Represent unplanned depreciation in the system

• Define depreciation areas

• Describe how a depreciation term is used in different depreciation areas

• Control the calculation of depreciation

• Analyse depreciation values

• Initiate the depreciation posting run

• Explain the task of the fiscal year change program and the year-end closing programs

• Choose and execute the various asset accounting reports

• Setup variable sorting and totalling for asset reporting

• Create the asset history sheet, and structure it to meet your needs

• Generate a depreciation forecast

• Simulate depreciation for assets

Reporting

• Create evaluations in the information system.

• Customize the accounts receivable/accounts payable information system.

• Use drilldown reporting.

• Define forms and execute reports.

• Create, change and execute queries.

Financial Closing

• Perform month and year-end closing in Financial Accounting (exchange rate valuation, post provisions etc.)

• Create balance sheet and profit and loss statements.

• Monitor closing operations using the Financial Closing Cockpit.

• Post accruals with accrual documents and recurring entry documents.

• Manage posting periods.